Capitaland Mall Trust (SGX: C38U) is a retail REIT listed in Singapore with retail properties all across Singapore. As at the date of this analysis, Capitaland Mall Trust is traded at SGD2.06.

Here is a quick background of Capitaland Mall Trust for the benefit of those who are new to this REIT. Capitaland Mall Trust is the very first REIT to be listed in the Singapore Exchange back in July 2002. As at the inception of the REIT, there are only 3 properties in their portfolio being Junction 8, Tampines Mall and Funan Digital Life Mall. To date, they have grown to 15 retail properties across Singapore with c.11% stake in Capitaland Retail China Trust.

As a retail REIT, their main revenue is derived through rental from tenants, revenue earned from car park and revenue from their other investments. In this post today, we will be discussing on the 6 key things Capitaland Mall Trust 2019 performance.

1. Strong and Growing Occupancy rate

The first aspect we will be looking at would be the operational performance of Capitaland Mall Trust in 2019 and more importantly over the past few years. If we were to look at their occupancy rate, it has been growing consistently from 97.6% in 2015 to 99.3% in 2019. Individually, all the properties registered an occupancy rate above 95% in the last 5 years. This is due to the location of all its properties whereby their properties are located near the MRT.

If you were to look at the performance for Funan Mall, you will notice that there is no available information from 2016 to 2018. This is due to the redevelopment of Funan in July 2016 to cater to the evolving retail landscape. It was later reopened in June 2019 with a staggering 99% occupancy rate.

2. Low Tenant Concentration Risk

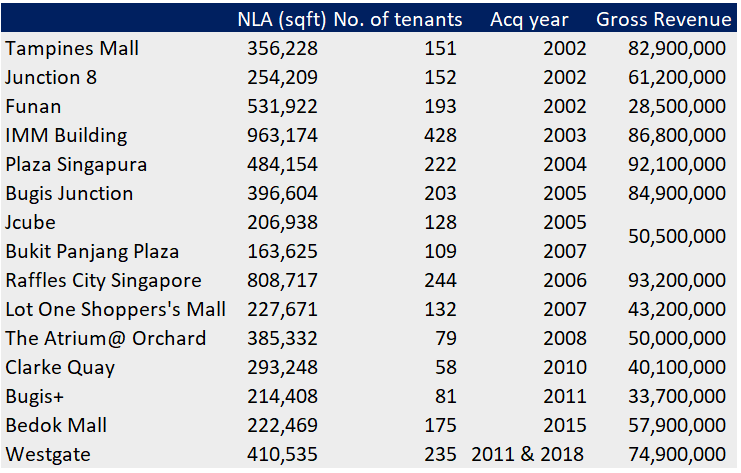

The second key things you need to know about Capitaland Mall Trust is the tenant profile. Based on the 2019 annual report, they have a relatively low tenant concentration risk. There is no single tenant which account for more than 4% of the REIT total gross rental income. The top 2 tenant are RC Hotel (Pte) Ltd and NTUC Enterprise which both account only of 3.2% of the total gross rental income.

If you look at number of tenants in each of the properties, it ranges from 58 tenants to 428 tenants which is relatively huge. A lost in a few tenants would not be detrimental to Capitaland Mall Trust.

3. Stable and consistent growth in revenue and NPI

The revenue of Capitaland Mall Trust consists of revenue from the properties owned as well as from Raffles City Singapore owned via a joint venture. The gross revenue has been growing consistently from SGD787.2 mil in 2015 to SGD879.9 mil in 2019. The stable increased throughout is mainly contributed by the improved occupancy rate as discussed in the earlier point and a positive rental reversion of about 0.8% in 2019 itself.

If you were to look at the performance in 2017, you will notice a slight dip from SGD807.5 mil in 2016 to SGD 795.4 mil in 2017. This is due to the close of Funan Mall for redevelopment works in July 2016. Upon reopening in June 2019, it has contributed positively to the overall gross revenue of the REIT.

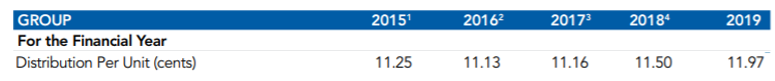

4. Stable distribution per unit

The next aspect we will be looking at is the distribution per unit (DPU) of Capitaland Mall Trust. Looking at the DPU over 5 years, we note an increasing trend which is a positive aspect for investors. The only dip is in 2016 where the DPU drop from 11.25 cents in 2015 to 11.13 cents in 2016. The decline was due to the closure of Funan Mall in July 2016. Upon the successful reopening of Funan in June 2019, it has contributed to the increase in DPU to 11.97 cents.

Looking at the yield itself based on 31 December 2019 closing price of SGD 2.46, this would give investors a yield of 4.87%.

5. Gearing and Borrowing

Capitaland Mall Trust has a total borrowings of SGD 3,561 mil as at 31 December 2019 which put them at a leverage ratio of 32.9%. This is still within the permissible range of 45% (with a recent announcement to increase the limit to 50%). This would still give them some debt headroom for further acquisition and enhancement initiatives.

Of the total borrowings, a huge proportion of the borrowings are fixed-rate borrowings with a small portion relating to floating-rate interest loan. This essentially means that they will not be materially affected by interest rate movement in the near term. You can read more on how interest rate affects REITs in one of the articles we few weeks ago.

6. Price to book above 1 (overvalued)

The net asset value per share of Capitaland Mall Trust in December 2019 is SGD2.07. Comparing this to the closing price as at 31 December 2019, this would translate to a price to book ratio of approximately 1.2.

Over the past 5 years, the Capitaland Mall Trust average price to book ratio was at approximately 1.1.

Summary

Overall, Capitaland Mall Trust is definitely one of the REIT which have been around for a quite a while now. The properties in their portfolio are mostly well-known malls in Singapore known by many. Furthermore, the REIT manager has been delivering a fairly solid performance.

As an investor, you will then have to ask if the dividend yield and similarly whether it is worth buying at the current price. From REIT Pulse opinion, though the REIT has been performing fairly good, the dividend yield is not attractive given the higher premium that investor has to pay (price to book greater than 1).

The impact of circuit breaker and the gradual reopening by phase is another area investor needs to look out for. What are your thoughts on Capitaland Mall Trust?

If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.