IGB REIT is a retail REIT which owned the prominent Mid Valley Megamall and The Gardens Mall. Being a retail REIT, IGB REIT has been adversely impacted by the COVID-19 pandemic. In this post, we will be diving into IGB REIT FY21 performance to see how it has performed.

Read More:

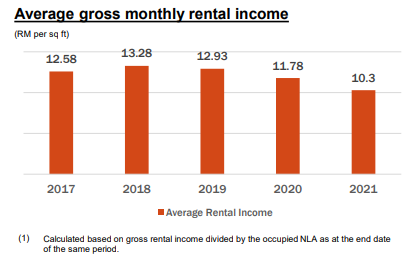

1. Strong occupancy rate with declining gross monthly rental income

| Occupancy rate % | FY19 | FY20 | FY21 |

| Mid Valley Megamall | 99.90% | 99.70% | 99.60% |

| The Gardens Mall | 98.90% | 91.80% | 99.50% |

Occupancy rate of both Midvalley Megamall and The Gardens Mall remains strong at c.100%. The Gardens Mall which suffers slights decline in FY20 has improved tremendously in FY21 growing from 91.8% in FY20 to 99.5% in FY21. This is as a result of less stringent measures in Malaysia.

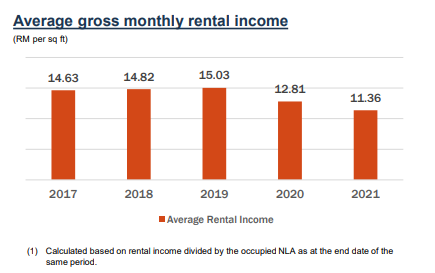

While occupancy rate has grown in FY21, IGB REIT has been reporting a year on year decline in average gross monthly rental income. Pre-Covid, the average gross monthly rental income of both assets has been on an uptrend. The impact of COVID-19 on the retail sector is particularly visible across retail REITs with average monthly rental income declining since 2019. Looking at Midvalley Megamall, average gross monthly rental income has declines from MYR 15.03 per square foot in FY19 to MYR 11.36 per square foot in FY21.

This decline would no doubt adversely impact the overall financial performance of IGB REIT.

2. Year-on-year decline in overall financial performance

| MYR in mil | FY19 | FY20 | FY21 |

| Revenue | 552.1 | 465.2 | 399.5 |

| – Mid Valley Megamall | 386.9 | 322.6 | 281.1 |

| – The Gardens Mall | 165.3 | 142.7 | 118.4 |

| Net Property Income | 398.8 | 316.7 | 275.1 |

| – Mid Valley Megamall | 294.9 | 231.6 | 200.3 |

| – The Gardens Mall | 103.8 | 85.1 | 74.8 |

From the perspective of IGB REIT financial performance, both revenue and net property income has continue to decline. Revenue declined from MYR 465.2 million in FY20 to MYR 399.5 million in FY21 while net property income declined from MYR 316.7 million in FY20 to MYR 275.1 million in FY21. Despite an overall improvement in occupancy rate to close to 100%, the overall financial performance continues to decline driven by higher rental support which was provided to tenants as a result of COVID-19 and as a result of MCO.

3. Declined in distribution per unit from 6.75 in FY20 to 6.03 cents in FY21

| MYR in cents | FY19 | FY20 | FY21 |

| Distribution per unit | 9.16 | 6.75 | 6.03 |

In line with the decline in financial performance, distribution per unit of IGB REIT has likewise declined from 6.75 cents in FY20 to 6.03 cents in FY21. From a distribution yield perspective, this translates to a yield of 3.65% based on FY21 closing price. We will let you decide if this is attractive.

4. Gearing level remain low and healthy

| FY19 | FY20 | FY21 | |

| Gearing % | 26% | 26% | 26% |

As at 31 December 2021, IGB REIT has a total borrowings of MYR 1.2 billion which translates to a net gearing of 26%. This is way below the permissible limit giving them ample debt headroom for further asset acquisition and enhancement initiatives to further grow their overall performance.

5. Promising outlook with slight uncertainty from Omicron variant

Prospect for the retail sector appears to be promising with a projected 6% growth in retail sales for 2022. This is from the expected gradual recovery from the impact of COVID-19 pandemic whereby retailers are expecting sales to pick up with improvement in overall footfall. Furthermore, the rising vaccination rate, relaxation of containment measures and potential gradual opening to overseas travelers would further drive the sector performance.

The downside is however the uncertainty from the new Omicron-dominant Covid-19 infections which are rising on a daily basis.

Summary

Based on our overall analysis, IGB REIT being predominantly in the retail sector are greatly affected by the COVID-19 pandemic. While occupancy rate has improved in FY21, financial performance has not recover from the COVID-19 impact. The positive aspect is that there has been initial signs of gradual recovery in footfall and vehicle traffic volume.

There are many angles to look at from a valuation standpoint. From a price to book valuation perspective, IGB REIT is currently overvalued trading at price to book of 1.54.

What are your thoughts on IGB REIT FY21 Performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.