When it comes to evaluating REITs, there are a number of areas one should look into. One of the key aspect we think is crucial is the REIT operational performance. For those who are new to REITs, here’s a post which will help you understand more about them.

Read More: What are REITs and what you should know about them

The business model of a REIT is pretty straightforward. The REIT leases out their properties space in return for rental income. These net rental income would then be distributed out to investors. Hence, as an investor, the more net rental income the REITs earned, the greater the yield will be.

Given the simplistic nature of the business, you would have noticed that the few ways the REIT can increase its return are through:

- Organic Growth which is essentially the growth through its existing operations

- Inorganic Growth is growth through acquisitions activities

Regardless of the form, we view that these operational aspects of a REIT is key when it comes to evaluating the REIT. As such, we will be looking into 5 areas you should look at when evaluating its operational performance. Hopefully, this gives you some insights on what to look at when you review your REIT.

1. Occupancy Rate

The first aspect you should look at when evaluating a REIT operational performance is the occupancy rate of the REIT’s portfolio. It is the measure of the percentage of rented space over the total amount of available space. This metric allows investors to gauge how well the property is utilized. For instance, if you have a 4 room flat to be rented out to potential tenants and only 3 out of the 4 room is being rented out. This would translate to a 75% occupancy rate.

This is an important metric as the higher the occupancy rate, the greater the rental income which is being collected. As investors, we should always lookout for an overall improvement in occupancy rate year on year. At the very least, a healthy range.

Here are some pointers you can consider when reviewing your REIT’s portfolio occupancy rate:

- Review its occupancy rate against its historical rate

- Compare its overall occupancy rate against the market average or its other peers

- Consider reviewing the occupancy rate by individual properties (at least for the material ones)

Improvement in occupancy rate typically translates to an increase in financial performance (assuming other factors remain constant). Here is an extract of Capitaland Retail China Trust portfolio occupancy rate.

2. Rental Reversion

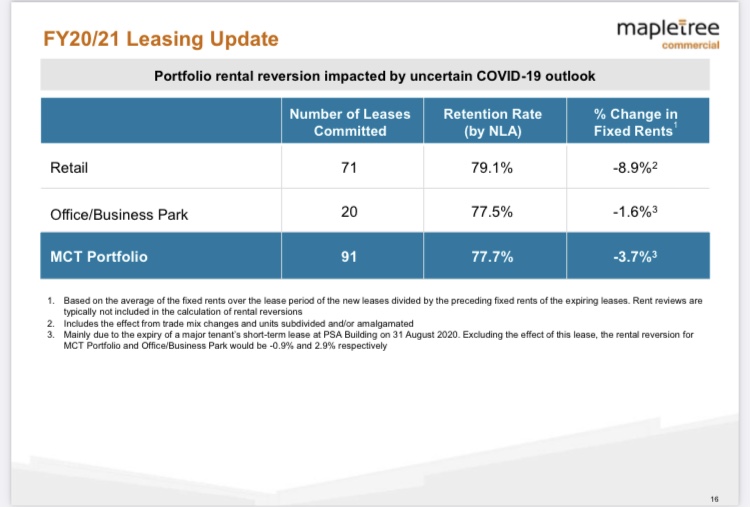

The second aspect of a REIT operational performance which is also a subset of organic growth is the rental reversion. Rental reversion is a metric used to measure if newly signed leased are entered at higher or lower rental rates. An increase in rental rates is defined as a positive rental reversion whereas a decrease is defined as a negative rental reversion.

So why does this matter? Let’s use the 4 room flat example earlier. We will assume that the 4 room flat is fully occupied at an occupancy rate of 100% with a rental income of $12,000 p.a. With that example, you will notice that that the flat has already been fully occupied, the only way the earnings can be increased is if you successfully renew the lease to a higher amount, say $13,000 p.a. This increase is then defined as a positive rental reversion.

In a REIT scenario, investors should always look out for a positive rental reversion as this is an indicator of a strong market outlook. Most importantly, it translates to higher earnings. Here is an extract of Mapletree Commercial Trust rental reversion information in 1H20.

3. Tenant and Industry Concentration

The third operational aspect when it comes to a REIT operational performance we will look into is the tenant and industry concentration.

Tenant Concentration

Tenants are the drivers of the REIT success. Without tenants, there will not even be prospect for REIT in the first place.

As such, the quality of tenants and the REIT tenant management is a key aspect in ensuring a sustainable outlook. Tenant concentration risk is essentially a huge reliance on a few big tenants. Let’s look back at the 4 room flat example. If the 4 rooms are all leased out to the same individual, this would then mean that you rely solely on one tenant. Any adverse event (bankruptcy, default etc.) would then be detrimental to your rental collection.

On the other hand, if you were to lease the 4 bedroom flat to 4 different individuals, a default by one tenant will not be as detrimental as compared to the earlier example. This is the same when it comes to evaluating REITs, a huge reliance on a few key tenants is usually something investor need to monitor closely. Ideally, the REIT should have a minimal exposure to individual tenants.

Industry Concentration

Aside from tenant concentration, another aspect you can look at is the industry concentration. Industry concentration is a measure on the reliance of rental from a specific industry. The REIT may not necessary have a huge reliance on few tenants. Hence, the next step investor should look into is the industry the tenants are operating in. For instance, 43% of the rental income is contributed by tenants in the oil and gas industry. The risk here is that any event that has an adverse impact in that particular industry might likely impact your REIT.

An important point to note that some REIT operates in an environment with high tenant concentration such as healthcare REIT. Having a high reliance on an industry or tenant is not a deal breaker, just that it would pose a tenant concentration risk. Here is a extract of IREIT Global REIT tenant and industry profile which can usually be accessible in the annual report or the quarterly report.

4. Weighted Average Lease Expiry (WALE)

Weighted Average Lease Expiry (WALE) is another key operational aspect one should look into. It represents the average time period in years when all the committed leases of the REIT will expire. Essentially, this is an indication of the security of future income streams to investors.

To help you understand it better, WALE is calculated based on the length of all leases weighted in terms of individual tenants. Let’s look at the 4 bedroom flat example to further illustrate assuming the lease are signed with multiple tenants with a different lease term and negotiated income. Based on the table, you will then see that the weighted average lease expiry of the 4 bedroom flat is 3.4 years by area and 2.9 years by income. Here’s how it is calculated looking at WALE (area);

[(3 yrs * 40%) + (5 yrs * 20%) + (2 yrs * 20%) + (4 yrs * 20%) ]

These are information which are easily accessible in the annual report of the REIT.

5. Acquisition Initiatives

The final operational aspect investor should look out for is the REIT organic growth plans. Apart from the growth internally from the REITs operations, REIT can also grow through new acquisitions.

However, it is important to note that not all acquisitions are great acquisition. Ideally the acquisition should be a yield accretive acquisition where it increases the earnings.

That pretty much sum up some of the operational aspect every investors should look out for when reviewing their REIT. Hopefully this would give you some insights the next time you review your REIT.

If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.