Frasers Centrepoint Trust is a retail-based REIT with properties across Singapore. They were listed on the Singapore Exchange in July 2006 and is an index constituent of a number of benchmark indices such as SGX iEdge S-REIT Leaders Index, MSCI Singapore Small Cap Index and NAREIT Global Real Estate Index Series.

One of the favourable aspects of Frasers Centrepoint Trust is its strong link to Frasers Property Limited. They are managed by Frasers Centrepoint Asset Management which is a wholly-owned subsidiary of Frasers Property Limited. For those who do not already know, Frasers Property Limited is a strong real estate and property management company that develop, own and manages property across the globe. With the strong backing from them, Frasers Centrepoint Trust will no doubt benefit from their expertise.

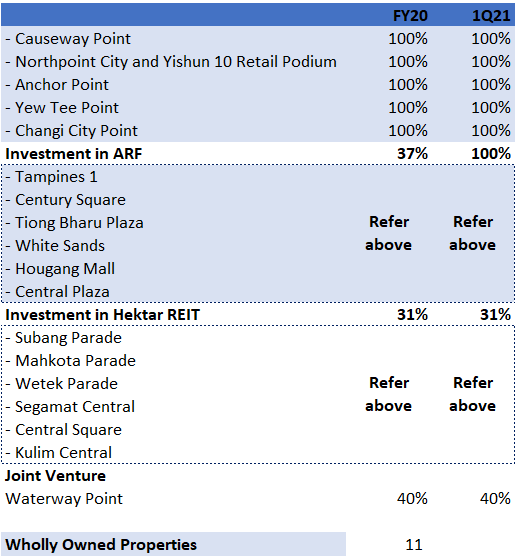

As of the date of this analysis, Frasers Centrepoint Trust wholly owned a total of 11 properties across Singapore. Apart from the fully owned assets, they have also entered into a joint venture which give them a 40% ownership of Waterway Point. Similarly, they have a 31% interest in Hektar REIT, a listed REIT based in Malaysia. Refer to the breakdown below to better understand the structure of the property ownership.

In this post, we will be looking at its historical and 1Q21 performance. Given that this is the first time we discuss this REIT, let’s get to know them better.

1) Proposed divestment of Anchorpoint for SGD 110 million

On 23 December 2020, the REIT Manager has announced its proposal to divest Anchorpoint Shopping Centre. The sale of Anchorpoint will be at SGD 110 million on a willing buyer willing seller basis which is expected to be completed by end of 2Q21. Anchorpoint was initially acquired back in 2006 at a price of SGD 36 million.

Based on the representation by the management, Anchorpoint has reached a stage where its divestment is in the interest of Unitholders, and they are looking to redeploy the proceeds into new acquisition of properties.

2) Divestment of Bedok Point

In 1Q21, Frasers Centrepoint Trust has completed its divestment of Bedok Point for SGD 108 million. Upon the completion of the divestment, this would being Frasers Centrepoint Trust total portfolio down to 11 properties as at 31 December 2020.

Note: Bedok Point is not stated in the ownership table above as it was reclassified as asset held for sale as at 30 September 2020.

3) Completion of the acquisition of remaining 63.11% of the total issued share capital of ARF

ARF was previously one of the largest non listed retail mall fund in Singapore. They owned 5 retail malls in Singapore being Tiong Bharu Plaza, White Sands, Hougang Mall, Century Square and Tampines 1. ARF also owns one office property in Singapore being Central Plaza. Prior to October 2020, Frasers Centrepoint Trust has a 36.89% stake on ARF. On October 2020, Frasers Centrepoint Trust completed its acquisition of the remaining 63.11% of its stake in ARF.

These acquisition would also mean that these properties are now fully owned by Frasers Centrepoint Trust.

4) Strong Occupancy Rate Despite Pandemic Challenges

| FY17 | FY18 | FY19 | FY20 | 1Q21 | |

| – Causeway Point | 100% | 98% | 97% | 97% | 98% |

| – Northpoint City and Yishun 10 Retail Podium | 82% | 97% | 99% | 95% | 99% |

| – Anchor Point | 96% | 89% | 79% | 93% | 96% |

| – Yew Tee Point | 96% | 94% | 97% | 97% | 96% |

| – Bedok Point | 85% | 79% | 96% | 92% | n.a |

| – Changi City Point | 89% | 94% | 96% | 90% | 91% |

| – Tampines 1 | n.a | n.a | n.a | n.a | 94% |

| – Century Square | n.a | n.a | n.a | n.a | 94% |

| – Tiong Bharu Plaza | n.a | n.a | n.a | n.a | 99% |

| – White Sands | n.a | n.a | n.a | n.a | 98% |

| – Hougang Mall | n.a | n.a | n.a | n.a | 96% |

| – Waterway Point | n.a | n.a | 98% | 96% | 98% |

| Retail Portfolio | 92% | 95% | 97% | 95% | 96% |

| – Central Plaza | n.a | n.a | n.a | n.a | 95% |

In terms of its historical occupancy rate, Frasers Centrepoint Trust has been reporting a fairly healthy occupancy. Its retail portfolio occupancy improve from 92% in FY17 to 96% in 1Q21. This is commendable despite the COVID-19 pandemic challenges faced. A plus point worth noting is the acquisition of the remaining stake of ARF which essentially give Frasers Centrepoint Trust full ownership of the underlying properties. Given the strong occupancy of these properties, this is definitely a favourable aspect.

5) Overall improvement in financial performance with the exception of FY20 as a result of the COVID-19 pandemic

| SGD in million | FY17 | FY18 | FY19 | FY20 | 1Q21 |

| Revenue | 181.6 | 193.3 | 196.4 | 164.4 | N.a |

| Net Property Income | 129.6 | 137.2 | 139.3 | 110.9 | N.a |

| Share of results of associates | 3.6 | 4.0 | 22.5 | 75.3 | N.a |

| Share of results of joint ventures | 0.6 | 0.6 | 6.4 | 11.2 | N.a |

Almost every aspect of the financial performance of Frasers Centrepoint Trust have improved with the exception of FY20. Its net property income improved from SGD 129.6 million in FY17 to SGD 139.3 million in FY19. This is mainly attributed to the stable and increasing and occupancy of its overall portfolio. The net property income for FY20 on the other hand has declined mainly due to rental rebates assistance granted to tenants.

A huge part of their operations include their investments in associates and joint venture. Both the performance have improved with share of result of associates increasing from SGD 3.6 million in FY17 to SGD 75.3 million in FY20. The key reason for the increase is from the increase in ownership stake of ARF which holds a number of key properties.

Moving forward, the share of associates would decrease offset by an increase in overall net property income with the completed acquisition of the remaining stake in ARF.

6) Distribution Per Unit increased from FY17 to FY19 with a drop in FY20

| SGD in cents | FY17 | FY18 | FY19 | FY20 |

| Distribution Per Unit | 11.9 | 12.015 | 12.07 | 9.042 |

Its distribution per unit has increased from 11.9 cents in FY18 to 12.07 cents in FY19 before declining to 9.042 cents in FY20. This is greatly in line with the financial performance of Frasers Centrepoint Trust where rental rebate was granted to eligible tenants in FY20.

Read More: Why you should never buy a REIT purely based on its dividend yield

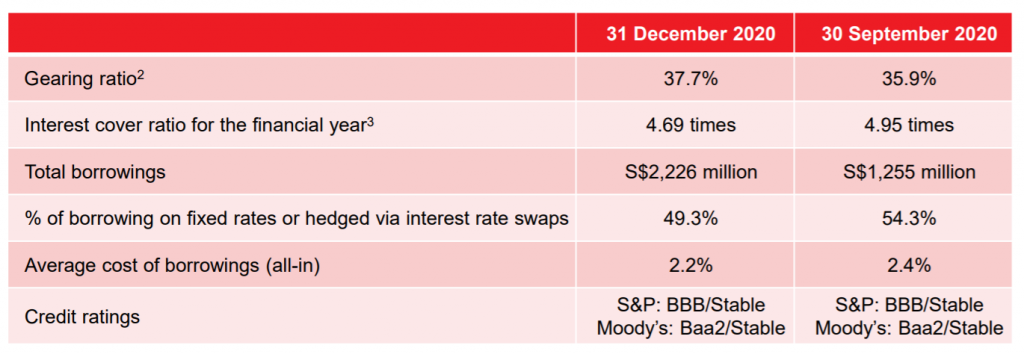

7) Gearing at healthy level

As at 31 December 2020, Frasers Centrepoint Trust has a total borrowings of SGD 2.2 billion which translates to a gearing of 37.7%. This is still below the permissible limit giving them ample debt headroom for further asset acquisition or asset enhancement initiatives.

Summary

Based on our analysis, there have been a number of developments in regards to Frasers Centrepoint Trust in the past few months. The acquisition of the remaining stake of ARF is likely a favourable move to them especially with the economy gradually recovering. Its overall financial and operational performance have been stable with the exception of FY20 due to the COVID-19 pandemic.

What are your thoughts on Frasers Centrepoint Trust? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.