Prime US REIT (SGX: OXMU) is a Singapore listed REIT which focusses on office and real estate-related assets in the United States. The REIT is listed on Singapore exchange in July 2019. As at the date of this analysis, Prime US REIT is traded at USD 0.70.

Here is a quick background of Prime US REIT. As the REIT has only been listed for less than a year, information on historical performance are limited. Their property portfolio consists of 11 properties which are located across the United States as at December 2019.

1) Fairly good occupancy rate

The occupancy rate of Prime US REIT is at c.95.8% as at 31st December 2019. Another 2 similar REIT listed in Singapore with presence in the United States, Manulife US REIT and Keppel KBS US REIT has an occupancy rate of c.95.8% and c.93% respectively. It appears that Prime US REIT is doing fairly okay in terms of keeping the office occupied.

The weighted average lease expiry is at c.5.1 years which are decent. In a way, it translated to a fix lease income for at least 5.1 years (excluding the event where tenant default).

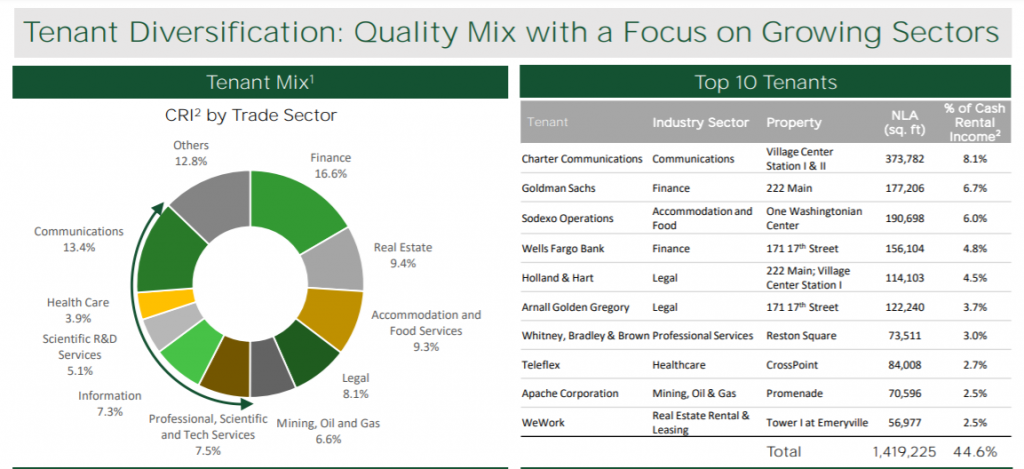

Based on the tenant mix, it is relatively diversified with finance and communication sector accounting for a higher proportion of the mix.

The few key things that would be of our concern going forward would be:

- Impact of COVID-19 on the resilience of the tenants.

- The impact on the oil price war between Russia and Saudi Arabia on the mining, oil and gas tenants.

2) Pre-IPO performance

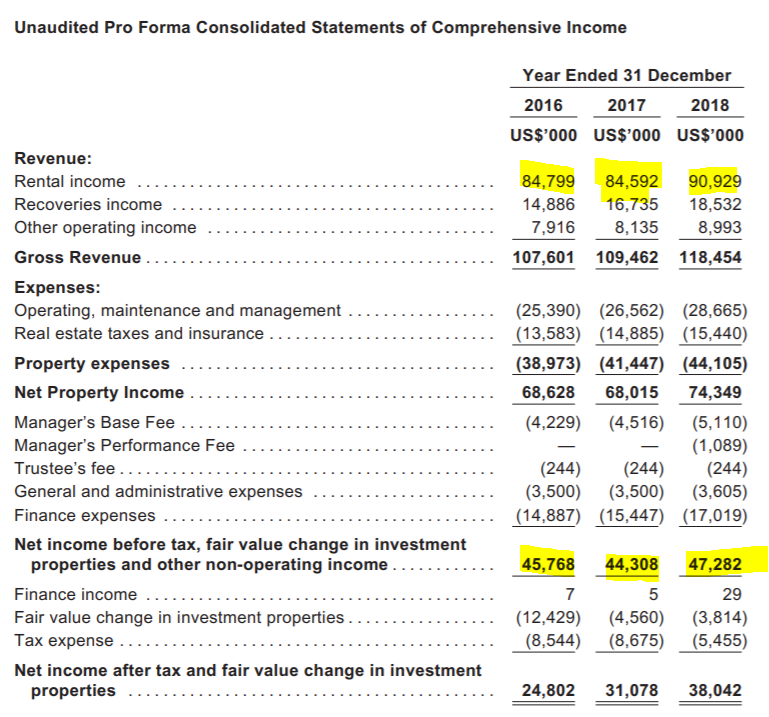

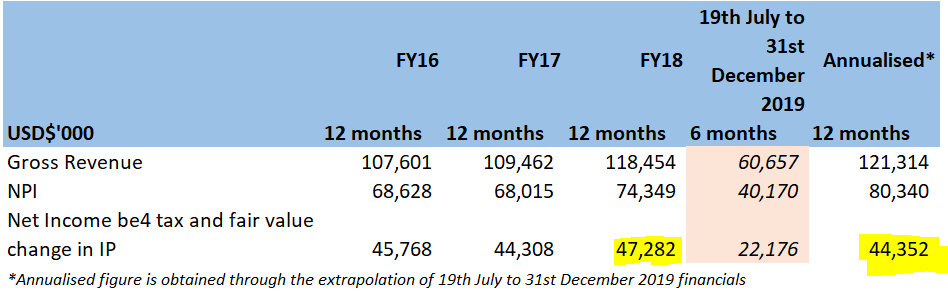

As Prime US REIT has only listed in 2019, we will have a high-level look at the performance before their IPO. The pre-IPO review period we are looking at is from FY16 to FY18.

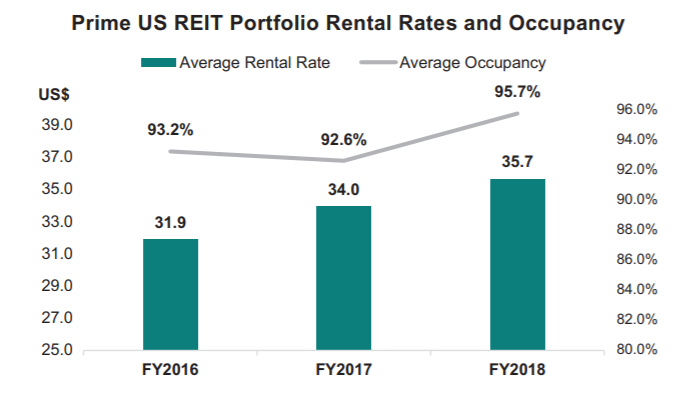

Overall, both the revenue and net income before tax and change in fair value has increased from FY16 to FY18 with a slight dip in FY17. The main contributor to the dip in FY17 is from a drop-in occupancy of 93.2% in FY16 to 92.6% in FY17. The occupancy rate quickly pick-up again in FY18.

In terms of the past average rental rate, we note an increasing trend from FY16 to FY18 which is a great indicator of positive rental reversion.

3) Financial Performance in 2019

As of now, the audited report has not been made available. Hence, we will be looking at the Q42019 Financial Results. This would give us 6 months of data after their listing. Along with the pre-IPO and 6 months of data, we have populated the table below for easier comparison.

Annualised net property income has increased from USD74.3mil in FY18 to USD80.3mil in annualised FY19. Net income before tax and fair value change in Investment Properties, on the other hand, has declined from USD47.3mil in FY18 to USD44.3mil in annualised FY19. Here’s why.

The decline is due to the net change in fair value of derivatives which was entered to hedge their floating rate interest exposure. This is a non-cash item and therefore does not affect income available for distribution to Unitholders.

Despite the positive performance in FY19, the lack of historical information and the uncertainty in the market due to COVID-19 would definitely be a question mark to investors.

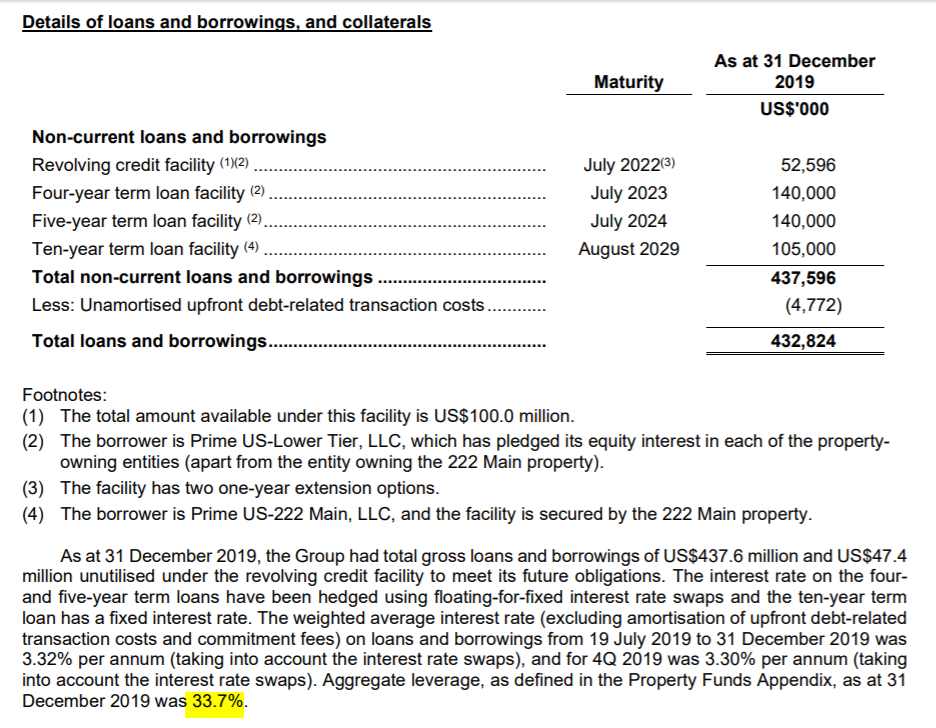

4) Gearing and borrowing

The gearing level of Prime US REIT is at 33.7% which is still within the permissible range. If we look at the total borrowings of USD 432 mil, it consists of both floating-rate interest loan and fixed-rate interest loan. However, the floating rate interest term loan is hedged via a fixed interest rate swaps. Essentially, this means that the term loan has been hedged against any interest rate fluctuation.

Depending on how you look at it, this would also mean that they are not able to enjoy the benefits during interest rate cuts.

5) Distribution per unit

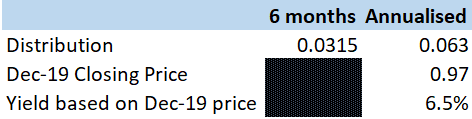

Having listed only in July 2019, there is no historical distribution information for us to look at. Prime US REIT has made their 1st distribution for the period 19th July 2019 to 31st December 2019 which amounts to US 3.15 Cents per Unit. This would translate to c.6.5% annualised dividend yield based on the Dec-19 closing price.

Based on the current trading price of this analysis at USD0.70, this would give a yield of 9%. But given the uncertainty in the COVID-19 development and it impacts on business, this would potentially be adverse to the REIT industry in general.

6) Price to book ratio

Price to book ratio is one of the indicators to identify undervalued REIT. As of 31st December 2019, Prime US REIT has a net asset value (NAV) of USD 0.89. Based on the market trading price of USD0.97 in December 2019, this would give a price to book ratio of 1.09. Which translated to the REIT being overvalued.

On the other hand, if you were to look at the price to book based on the current trading price of USD 0.70, that would come up with a price to book of 0.79 which indicates that the REIT is now cheap.

Summary

Though historical performance appears to be good, distribution yield at current trading price appears to be attractive and the REIT appears to be undervalued. Investors would need to factor in the potential impact of COVID-19 on the performance of the REIT’s tenant.

That’s it for our analysis on Prime US REIT. What is your take on Prime US REIT? Share your thoughts with us at the comment below.

If you like this analysis, here is more REIT analysis.