Ascendas REIT is a Singapore REIT operating in the business space and industrial sector. It has assets across various geographical region which we will be looking into shortly.

For those who are new to this REIT, Ascendas REIT is one of Singapore REIT pioneer which played a crucial role in the development of the REIT sector. They have approximately 200 properties spanning across Singapore, Australia, United Kingdom and The United States as at 31 December 2019. Ascendas REIT is managed by Ascendas Funds Management (S) Limited (AFM) which is a wholly owned subsidiary of Singapore-listed CapitaLand Limited (CapitaLand), one of Asia’s largest diversified real estate group. This is no doubt a plus point for Ascendas REIT being able to tap into CapitaLand expertise.

In this post, we will be looking into Ascendas REIT to help readers understand its historical performance as well as its performance in 1H20.

Historical Performance (FY17 to FY19)

1. Acquisition

In FY19, Ascendas REIT has completed its acquisition of 31 new properties. Of the 31 new acquisitions, 28 of it is located in The United States, 2 located in Singapore and 1 in Australia. The acquisition amount to approximately SGD 1.66 billion is the largest in the history of Ascendas REIT.

These acquisitions is beneficial to investors for a number of reasons:

- Firstly, it provides further growth opportunities for Ascendas REIT which would translates to greater distributions.

- Secondly, these acquisitions expand Ascendas REIT portfolio into The United States bringing its reach two 4 different geographical region. This would bring further diversification to the REIT.

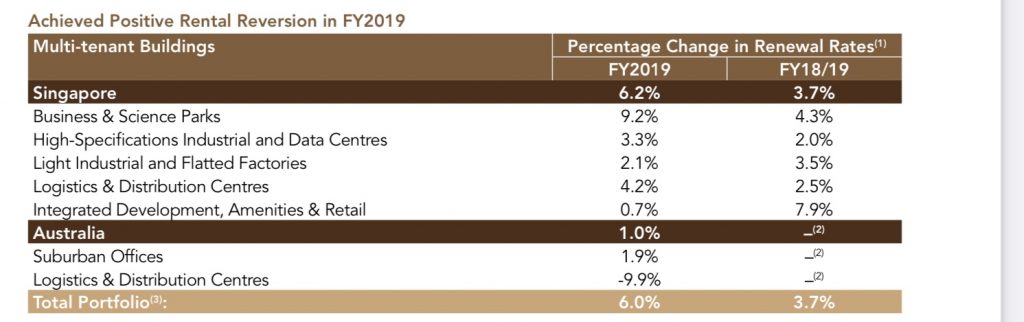

2. Stable occupancy rate with a positive rental reversion

The occupancy rate of Ascends REIT remain fairly stable at 90.9% as at December 2019. This is a slight drop as compared to the occupancy rate of 91.9% in March-19. The occupancy dropped is contributed by the different geographical region equally with a higher concentration in the Singapore market given the weightage. The dropped in Singapore portfolio is mainly from Wisma Gulab in which the property was subsequently divested in 1Q20.

Despite the slight drop in occupancy rate, Ascendas REIT registers an overall positive rental reversion of 6% in FY19. Of course this is prior to the effect COVID-19 outbreak. Definitely an area to keep an eye on in 2020.

An aspect investors can take comfort in terms of its operational performance is the low tenant concentration risk where there is no single tenants that account for more than 5% of Ascendas REIT total revenue in FY19,

3. Drop in financial performance due to change in FY but overall improve in financial performance

| SGD in mil | FY17/18 | FY18/19 | FY2019* |

| Gross Revenue | 862.1 | 886.2 | 699.1 |

| Net Property Income | 629.4 | 649.6 | 537.7 |

| *Change of FY from Mar-19 to Dec-19. |

The overall net property income declined from SGD 649.6 million in FY18 to SGD 537.7 million in 2019*. This decline is mainly due to the additional three months of performance in FY18. If we were to look at the performance on an apple to apple comparison by comparing the financial performance to the 9 months performance in the previous year, the net property income has increased by 10.6%.

The increase is mainly attributable to the 9 months contributions in 2019 from the UK logistics portfolios acquired in August 2018 and October 2018. Furthermore, there is also an additional contributions from the acquisitions made late 2019.

4. Distribution per unit decline due to timing mismatch in recognition

| Cents | FY17/18 | FY18/19 | FY2019* |

| Distribution per unit | 15.99 | 16.04 | 11.49 |

| *Change of FY from Mar-19 to Dec-19. |

The distribution in 2019 is lower at 11.49 cents as there is a change in financial year from March year end to December year end. Essentially this means that the performance in 2019 only consists of 9 months performance from Apr-19 to Dec-19.

Even factoring the 9 months performance, the distribution of 11.49 cents is still lower than the previous comparative period. The drop is mainly due to the mismatch in timing between the contributions from the newly-acquired business parks in The United States and Singapore in December 2019 and the additional number of unites issued.

We would expect the distribution per unit to increase in next the FY with the full rental income kicking in. However given the outbreak of COVID-19, this would impact the DPU in the short to medium term.

5. Gearing

The gearing of Ascendas REIT is at 35.1% consisting of total debt if SGD 4.65 billion. Of this total amount, 75.8% of the debts are fixed interest loan. This would mean that This portion of debts are not subject to interest rate risk.

Looking at from a different perspective, this also means that they are not able to benefit from a low interest rate environment.

Read More: How do interest rate affect REITs

1H20 Performance

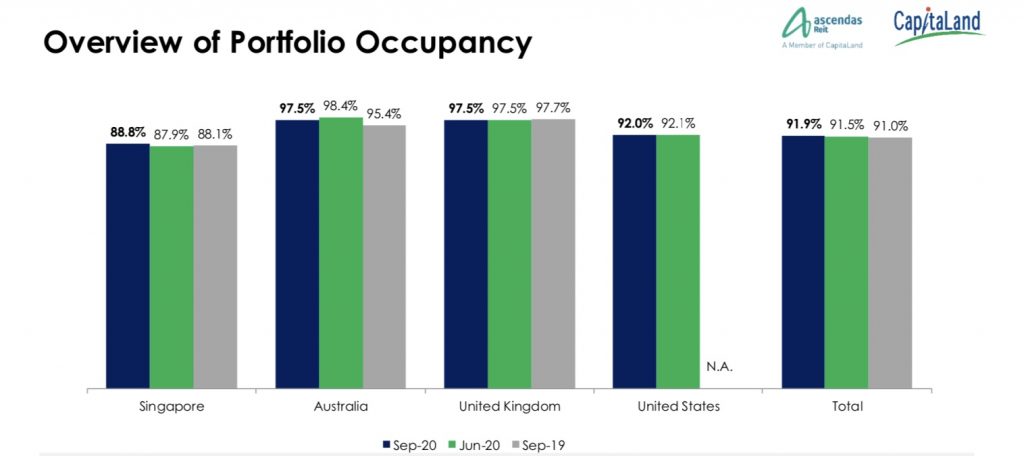

6. Fairly strong operational performance

Though the financials are not readily available for 3Q20, we will review the readily available operational information in 3Q20. By looking at its overall occupancy rate, it has gradually improved from 91.5% in Jun-20 to 91.9% in Sep-20. This is definitely a favourable aspect given that the occupancy in FY19 as share in the earlier points in 90.9%.

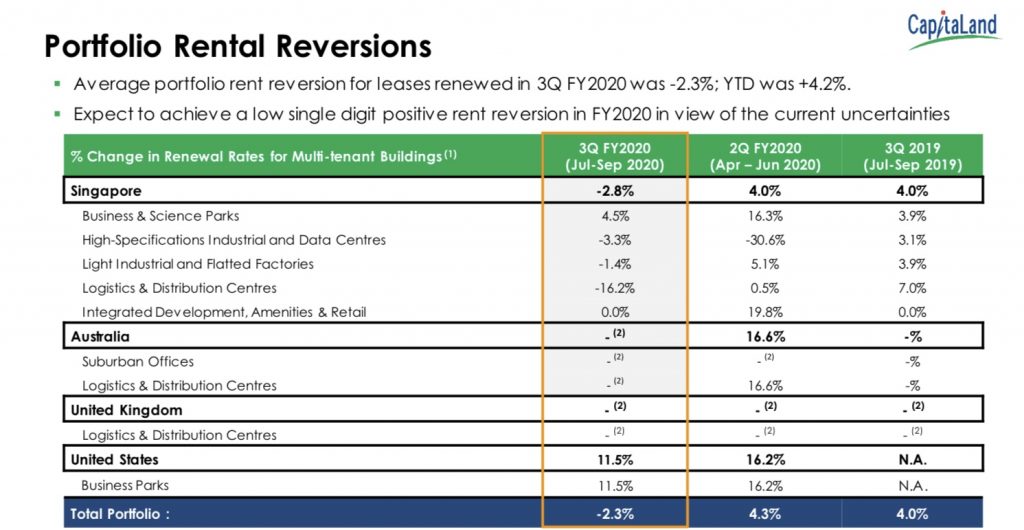

The downside is the negative rental reversion of -2.3% in 3Q20. Nevertheless, the overall rental reversion year to date is still a positive 4.2%. As per management, investors should expect a Low single digit positive rental reversion in FY20 in view of the current uncertainties.

7. Increased in net property income compared to previous half

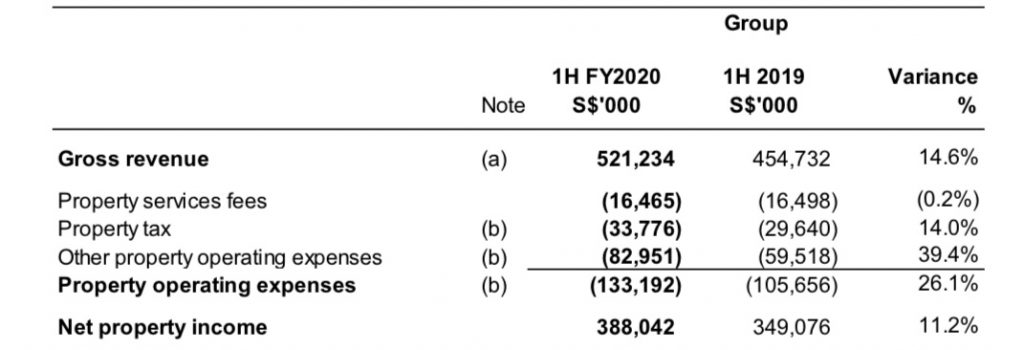

In 1H20, Ascendas REIT registers a net property income of SGD 388 million. This is as opposed to SGD 349 million in 1H19.The increase is mainly contributed by the newly acquired properties late 2019.

8. New acquisition in 3Q20 with another 2 acquisitions under development

In 3Q20, Ascendas REIT completed its acquisition of 254 Wellington Road in 11 September 2020. Furthermore, they have also announced another 2 acquisitions in Australia which will be due to be completed in 2021 and 2022 respectively.

Summary

Based on REIT pulse perspective, Ascendas REIT has been growing year on year both organically and inorganically with the REIT manager active acquisition initiatives. Financial performance have been improving as well with its operational performance being stable despite the COVID-19 outbreak.

Nevertheless, with the timing mismatch resulting in the drop in DPU in FY19, it will be interesting to see how it performed in FY20. Investors would also need to decide if it is worth investing with the price to book ratio 1.35 based on NAV of SGD 2.169 and late trading price of SGD 2.93.

What are your thoughts on Ascendas REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

join our community over at Facebook and Instagram.