Suntec REIT is a Singapore listed REIT with properties presence across Singapore, Australia and the United Kingdom. They invest mainly in the office and retail sector either wholly or partially. For those who are new to the REIT, here is a breakdown of the properties they owned.

| Properties | Ownership |

| Singapore Properties: | |

| Suntec City Mall | |

| – Suntec City Mall & Office | 100.0% |

| – Suntec Singapore Convention and Exhibition Centre | 66.3% |

| One Raffles Quay | 33.3% |

| Marina Bay Financial Centre | 33.3% |

| 9 Penang Road | 30.0% |

| Australia Properties: | |

| 177 Pacific Highway, Sydney | 100.0% |

| Southgate Complex, Melbourne | 50.0% |

| Olderfleet, 477 Collins Street, Melbourne | 50.0% |

| 55 Currie Street, Adelaide | 100.0% |

| 21 Harris Street | 100.0% |

| United Kingdom Properties: | |

| Nova Properties | 50% |

Throughout FY20, the entire year is filled with the uncertainty of the COVID-19 pandemic. Many businesses and people are affected by the various measures put in place by authorities from an economic and people well-being point of view. The way people work has changed with a huge reliance on technology and working from home arrangement.

Suntec REIT itself has been filled with a number of key events. There have been a number of developments in Suntec REIT since our last update in July 2020 up to its 1Q20 report. Hence, in this post today, we will be looking into Suntec REIT FY20 full-year performance.

Hopefully, it will give you greater insights on how it has performed.

1) Completed 2 acquisitions in Australia and the United Kingdom respectively

The first positive event for Suntec REIT FY20 is on the completion of its 2 acquisition. Both of these acquisitions is key as it help drive the overall financial performance in FY20.

Its first acquisition which was completed in April 2020 is 21 Harris Street located in Australia. 21 Harris Street is a nine-storey, Grade A office building located close to the Sydney’s Central Business District. This property was acquired for AUD 297 million and as at 31 December 2020, it has an occupancy rate of 68.7%.

The second acquisition is Nova Properties which was acquired for approximately GBP 430.6 million in December 2020. This acquisition is a milestone as it expand Suntec REIT reach into the United Kingdom. Nova properties comprises of two Grade A office buildings with ancillary retail.

2) Completed the development of 477 Collins in Melbourne

Second key event is the completion of the development of Olderfeet, 477 Collins Street in July 2020. This development is a new 39 level premium-grade office located within Melbourne’s Central Business District.

Similar to the 2 new acquisitions shared earlier, the completion of 477 Collins similarly helps drive the financial performance in FY20. As at 31 December 2020, this property has a committed occupancy rate of 97%.

3) Increased its stake in Suntec Singapore

On 1st July 2020, Suntect REIT has injected additional capital to the entities that holds Suntec Singapore International Convention and Exhibition Centre. Essentially this means that Suntect REIT has increased it stake in Suntec Singapore from 60.8% to 66.3%.

This move is in our opinion not favourable given the slow recovery of events with international and large-scale trade fairs being impacted by travel restrictions. At the similar instance, smaller-scale meetings and events are affected by safe distancing measures.

4) Overall decline in occupancy rate for both retail and office portfolio

With a number of key events during the year, it is interesting to see how Suntec REIT has performed operationally. In this segment, we will discussed Suntec REIT FY20 operational performance into two, office and retail segment.

| Commited Occupancy | 31-Dec-20 | 31-Dec-19 | 31-Dec-18 |

| Suntec City Office | 96% | 100% | 99% |

| One Raffles Quay | 97% | 98% | 96% |

| MBFC Towers 1 & 2 | 98% | 99% | 100% |

| 9 Penang Road | 100% | 97% | – |

| Singapore Office Portfolio | 97% | 99% | 99% |

| 177 Pacific Highway | 100% | 100% | 100% |

| Southgate Complex | 100% | 100% | 99% |

| 55 Currie Street | 92% | 92% | – |

| 21 Harris Street | 69% | – | – |

| 477 Collins | 97% | – | – |

| Australia Office Portfolio | 94% | 98% | 99% |

| Nova Properties | 100% | – | – |

| United Kingdom Office Portfolio | 100% | 98% | 99% |

In regards to its office sector, it has properties spreading across 3 countries namely Singapoe, Australia and newly expanded United Kingdom. Its Singapore Office Portfolio has slightly declined from 99% in FY19 to 97% in FY20. This is mainly driven by the COVID-19 pandemic. Nevertheless, the average occupancy rate of its Singapore office portfolio is still above overall CBD occupancy of 93.2%.

Its Australia portfolio remains fairly stable with its 3 existing properties maintaining its occupancy rate in FY19. On top of the existing properties, there have been two new addition to the Australia office portfolio in FY20.

Similarly, in the United Kingdowm, there is also a new addition of Nova properties with a committed occupancy of 100%.

| Commited Occupancy | 31-Dec-20 | 31-Dec-19 | 31-Dec-18 |

| Suntec City Mall | 90% | 100% | 100% |

| Marina Bay Link Mall | 92% | 98% | 99% |

| Singapore Retail Portfolio | 90% | 100% | 100% |

| Southgate Complex | 92% | 93% | 91% |

| Australia Retail Portfolio | 92% | 93% | 91% |

As for the retail sector, both its Singapore and Australia portfolio occupancy has declined as compared to FY19.

5) Overall dropped in financial performance

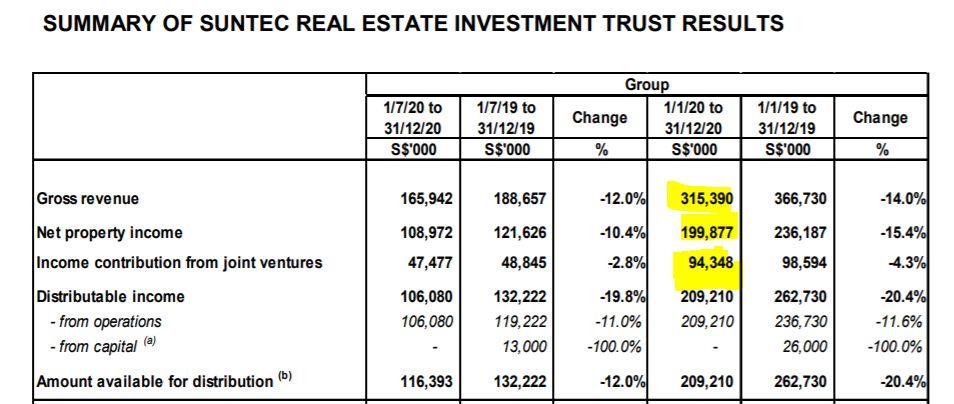

With the drop in occupany rate in FY20 for both its office and retail segment, it is not surprising that its overall financial performance has decline. Its retail and Suntec exhibition properties are the mainly drivers of the dropped in revenue with safe distancing and travel restriction still in place.

Looking at its net property income, it has declined from SGD 236.1 mil in FY19 down to SGD 199.9 mil in FY20. Its contribution from jont venure has similarly decline from SGD 98.6 mil in FY19 to SGD 94.3 mil in FY20.

The decline in FY20 was partially offset from the 3 newly acquired and developed building in Austrlia and UK. Going forward, it will be interesting to see how things turnaround with the introduction of vaccine and loosening of COVID-19 measures.

6) 22.1% decline in distribution per unit in FY20

Distribution per unit for FY20 is 7.4 cents per unit down from 9.5 cents in FY19. With the 3 new additions of assets income kicking in FY21, it will be interesting to see how things turns out.

7) Gearing level increased to 44.3%

Gearing on the other hand increased from 37.7% in FY19 to 44.3% in FY20. This is contributed by the increased in borrowings during the year. Despite the increase in gearing level, this is still within the permissible limit but nevertheless, still fairly high compared to its peers.

Summary

Based on our analysis, Suntec REIT has no doubt been affected by the COVID-19 pandemic both financially and operationally. In the near to medium term, it is likely that its convention centre’s recovery will be slow with a gradual recovery from its retail and office related assets. The 3 new properties addition to Suntec REIT will help cover the gap in revenue from the slow recovery of its existing properties.

What are your thoughts on Suntec REIT FY20 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.