Elite Commercial REIT (SGX: MXNU) is a Singapore listed REIT which invests in commercial real estate assets in the United Kingdom. Listed in February 2020, they are Singapore first and only UK-focused listed REIT.

They owned a total of 97 commercial buildings located across the UK with investment properties valued at GBP 296 million. Approximately 99% of its gross rental income are derived from the AA-rated UK government. This is a favourable aspect as it provides Elite Commercial REIT with a recession-proof yield.

Given that Elite Commercial REIT was only recently listed, there is not much information to look into. As such, in this post, we will look into its latest available information mainly the Q2 and Q3 2020 information.

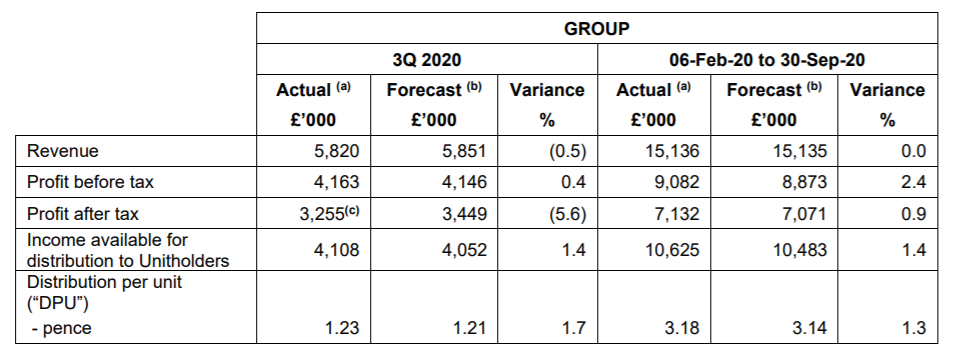

1) Overall financial performance outperform its initial forecast

We will start out by looking into its financial performance since its listing. Based on the initial forecast, Elite Commercial REIT has outperformed in some aspect. The main drivers of the strong financial performance is from the revenue itself where over 99% of it are derived from the UK Government.

This is occupied by The Secretary of State for Housing, Communities and Local Government occupying the properties under a group sharing arrangement. Leasing to Governmental bodies is favourable to the REIT as they are typically stable.

In terms of the balance of the rental income, they are leased to a small group of retail tenants. Which is not very material in this respect.

Apart from the revenue, another favourable aspect is the lease arrangement entered via a triple net lease arrangement. This arrangement covers close to 99% of the operations which was leased to the UK Government. With the arrangement, the majority of the property expenses are borne by the tenants. Hence, reducing the expenses fluctuations.

2) Distribution Per Unit in line with expectation

The next expect we will look at is the distribution per unit which is one of the key reasons investors invest in REIT. The distribution per unit as at 30 September 2020 is at EUR 3.18 cents, 1.3% higher than its forecast.

This is fueled by the strong financial performance of Elite Commercial REIT as shared in the earlier points. Assuming that they meet their DPU forecast by end of the FY, this would give investors an expected yield of 7.3% based on annualised forecasted DPU of 4.83 cents and the latest trading price of GBP 0.66.

3) Gearing within a healthy level

As at 30 September 2020, Elite Commercial REIT has a gearing of 33.1%. This is well within the permissible limit of 50% which will give them ample debt headroom for further acquisition and asset enhancement initiatives.

Of the total borrowing, approximately 50% of the borrowings are fixed in nature. This would mean that another 50% of the borrowings are subject to interest rate risk.

Read More: How does interest rate affect REITs

4) Strong Occupancy rate as at 30 September 2020

From the operational performance standpoint, Elite Commercial REIT has been rather stable. It has a 100% occupancy rate as at 30 September 2020 with an average weighted average lease expiry (WALE) of 7.5 years. A fairly long WALE in our opinion.

Another favourable point which would interest investor is in terms of its rent collection policy. Elite Commercial REIT collects close to 99.6% of the rent in advance for the 3- months period of October 2020 to December 2020. This is definitely a plus given the uncertainty of the COVID-19 pandemic.

5) Strong reliance on the UK Government

As shared earlier, approximately 99% of Elite Commercial REIT rental income comes from the UK government. This is favourable in the way that it is unlikely for the UK government to default on its rental payment. With that, it will provide Elite Commercial REIT a stable stream of income over the lease period.

On a separate note, the heavy reliance on the UK Government also poses tenant concentration risk. Here are a number of adverse scenarios we could think of which will be detrimental to the REIT:

- Upon the expiry of the lease, all the leases were not renewed.

- Given the heavy reliance of 99% of income from the UK Government, there would be a potential scenario where they negotiate for a lower rent.

Depending on how you view this, it can be good and bad. From our personal standpoint, we would prefer a more balanced tenant concentration.

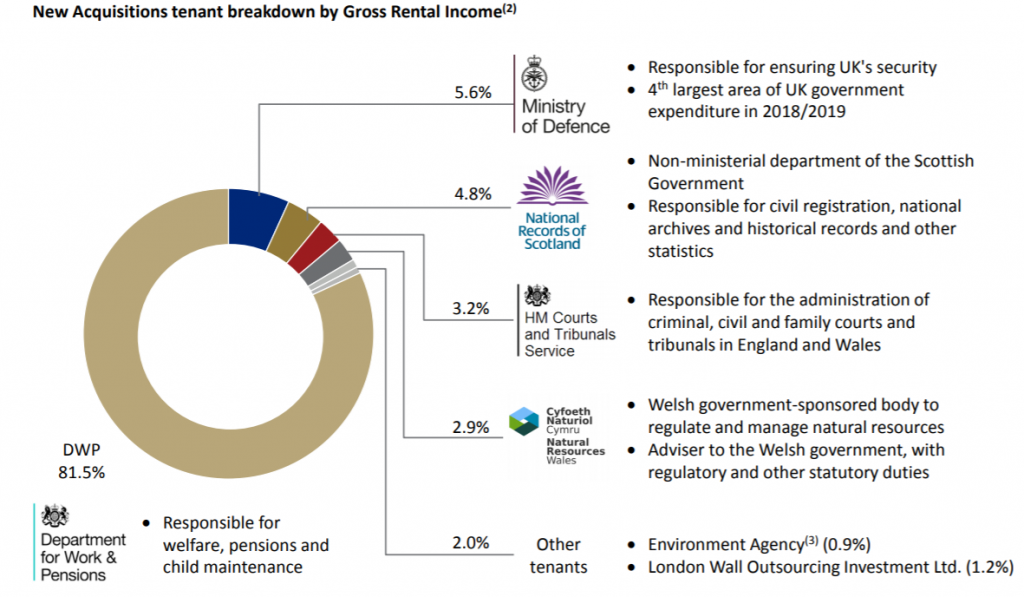

6) Proposed Acquisition Of 58 Properties Located Across The United Kingdom

On 19th October 2020, Elite Commercial REIT has proposed to acquire 58 properties. This acquisition is valued at GBP 212.5 million of which will further extend its geographical spread in the UK. The positive aspect of this deal is that it has a long WALE of 7.4 years with a 100% occupancy rate.

Similar to the existing portfolios, the acquisition will be primarily leased to UK Government entities.

Summary

Based on our overall analysis, Elite Commercial REIT despite newly listed have been performing fairly well. The fact that they are primarily leased to the UK government is a plus point to investors given that government are perceived to be stable. Of course, the heavy reliance on one key group of tenants can be a bad thing as well.

Nevertheless, we are in the opinion that the REIT manager has been proactive in growing the REIT.

What are your thoughts on Elite Commercial REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.