AmanahRaya REIT (KLSE: 5127) is a Malaysian based REIT listed in the Bursa Malaysia market on February 2007. The REIT is managed by AmanahRaya-Kenedix REIT Manager Sdn. Bhd which is a joint venture between AmanahRaya-REIT Managers (59%) and Kenedix Asia through its local subsidiaries, KDA Capital Malaysia (41%). Apart from being a joint owner of the REIT manager, KDA Capital Malaysia also owns 15% of the share of AmanahRaya REIT.

Read more: Understanding the REIT structure and its underlying expenses

These partnership is a plus for AmanahRaya REIT as it allows them to tap into the expertise of Kenedix Group management. For those who are not familiar with Kenedix Group, they are the largest independent real estate asset management organization in Japan with an asset under management (AUM) in Japan’s real estate market totaled approximately ¥2.4 trillion (as of Dec. 2019).

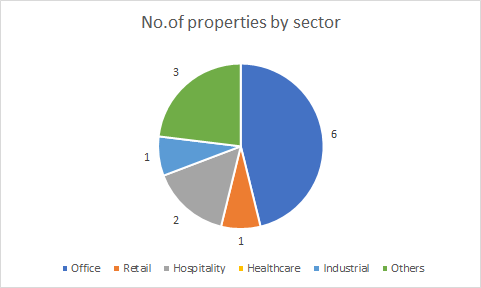

AmanahRaya REIT operates in multiple REIT sectors. As at 31 December 2019, they have a total of 13 properties across Malaysia predominantly in the office and education sector. In this post, we will be discussing more on AmanahRaya REIT FY19 and latest quarterly result.

1. Strong Occupancy Rate in the Education and Retail Sector

| FY17 | FY18 | FY19 | |

| Hospitality | |||

| Ex-Holiday Villa Alor Setar | 100% | Vacant | Vacant |

| Holiday Villa Langkawi | 100% | 100% | 100% |

| Education | |||

| Segi College, Subang | 100% | 100% | 100% |

| Segi College, Kota Damansara | 100% | 100% | 100% |

| Help University | 100% | 100% | 100% |

| Office | |||

| Block A&B South City Plaza (Prospective sale) | 50% | 50% | 50% |

| Toshiba TEC | 100% | 100% | 100% |

| Wisma Comcorp | 100% | 100% | 100% |

| Dana 13, Dana 1 Commercial Centre | 100% | 100% | 60% |

| Vista Tower | – | 70% | 68% |

| Contraves | 100% | 100% | 100% |

| Industrial | |||

| RHF Stone Factory | 100% | 100% | 100% |

| AIC Factory (Disposed on 26 June 2019) | 59% | Vacant | – |

| Gurun Automotive (Disposed on 16 December 2019) | 100% | Vacant | – |

| Silver Bird Factory (Disposed on 25 May 2018) | Vacant | – | – |

| Retail | |||

| Selayang Mall | 100% | 100% | 100% |

AmanahRaya REIT has properties in 5 different sectors namely office, industrial, education, retail and hospitality. Looking at the historical occupancy rate over the past 3 years, not all the sectors perform equally well. The education and retail sector which cumulatively account for approximately 34% of the gross income has a fairly high and stable occupancy of 100% throughout.

The office sector with a total of 6 properties are the biggest contributor (approximately 60% of the gross income) to AmanahRaya REIT. Looking at the historical occupancy, all but 2 properties, Vista Tower and Dana2, Dana 1 Commerical Centre have a decline in the occupancy rate. South City Plaza which has a historical occupancy of 50% is in the discussion for a prospective sale.

An area to highlight is the hospitality sector whereby one of the properties have been vacant since FY18. It will be an area investors should continue to pay close attention to on whether new tenants will be brought in or will the building be sold off.

2. Mixed Historical Annual Financial Performance

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 57,633 | 61,036 | 97,244 | 96,876 |

| Net Property Income | 53,549 | 53,799 | 79,570 | 80,666 |

| Net Realised Income | 35,333 | 31,650 | 37,966 | 37,137 |

The net property income of AmanahRaya REIT has been growing year on year from MYR 53.5 mil in FY16 to MYR 79.6 mil in FY18. The increase is mainly attributed by the increase in rental income from Vista Tower which was newly acquired in FY18. In FY19, the net property income further increased to MYR 80.7 mil mainly due to reduction of repair and refurbishment costs.

Net realised income on the other hand has increased in FY18 consistent with the increase in revenue and net property income. The dropped from MYR 37.9 mil in FY18 to MYR 37.1 mil in FY19 is mainly attributed by a lower financing cost in FY18 upon the disposal of Silver Bird Factory in May 2018.

3. Declining 1H 2020 Performance

Based on the latest available quarterly report, the financial performance has declined when compared to the previous half result in FY19. The major decline in revenue is due to the decreased rental of Vista Tower and Dana 13 due to the movement control order and COVID-19 pandemic. As a result of that, they have provided rental assistance or relief for the affected tenants.

Non property expenses, on the other hand has decreased. The borrowing cost which account for a huge proportion of non property expenses has decline from MYR 16.9 mil in 1H FY19 to MYR 14.1mil in 1H FY20 mainly from the settlement of Affin Term Loan and the decrease in the Overnight Policy Rate (OPR).

4. Borrowing variable in nature with relatively high gearing

| FY16 | FY17 | FY18 | FY19 | |

| Gearing | 30.3% | 50% | 44.7% | 43.8% |

As at 31 December 2019, AmanahRaya REIT has a total borrowings of MYR 644 million. Of the total loan, all of it is variable in nature. This would be subject to interest rate risk but given the interest rate cut in Malaysia, this would be potentially favourable to them in the short term.

The gearing level is relatively high at 43.8% in FY19 which is still below the permissible limit. Nevertheless, it has been declining from a high of 50% in FY17 to 43.8% in FY19.

Read More: How does Interest Rate Affect REITs

5. Increased Distribution Per Unit (DPU) from FY17

The next aspect we will be looking at is the distribution per unit (DPU) of AmanahRaya REIT. There is a slight decline from 5.90 cents in FY16 to 5.50 cents in FY17 due an increase in borrowing cost due to an additional drawdown of loan to fund the acquisition of Vista Tower.

From FY17 onwards, the DPU is on an increasing trend from 5.50 cents in FY17 to 6.20 cents in FY19 mainly from the contribution of Vista Tower. In terms of performance moving forward, the uncertainty of COVID-19 pandemic should definitely be an area investors should keep an eye on.

Summary

Overall the performance of AmanahRaya REIT has been stable mainly in the education sector. The office sector which account for the major proportion of the REIT operations appear to be in a declining trend with Vista Tower and Dana 13 occupancy declining. The decline is evident from the dropped in revenue in 1H FY20 as compared to the previous half. Uncertainty of COVID-19 pandemic has also affected them adversely.

It will be interesting to see if they are able to continue the increasing DPU. However, looking at the 1H2020 result, it is likely that the DPU would decline. Furthermore, the gearing though is on a declining trend is still fairly high.

Comparing the NAV per unit as at 31 December 2019 of MYR 1.3548 to the latest traded price of MYR 0.67, it would give investors a price to book of approximately 0.5. We will let you decide if this is worth investing it.

What are your thoughts on AmanahRaya REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.